arizona estate tax exemption 2020

Federal law eliminated the state death tax credit effective January 1 2005. 25 of the gross system cost up to a maximum of 1000.

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

No separate state QTIP election permitted.

. Exemption by the taxpayers tax rate to determine the reduction in tax. The Arizona State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Arizona State Tax Calculator. This Certificate is prescribed by the Department of Revenue pursuant to ARS.

The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. You must be a resident of Arizona. Married Filing Joint - 24400.

In 2020 it set at 11580000. As noted in the chart below the largest category is the state sales tax which represented 465 of General Fund revenue collections in 20FY 20. With the right legal steps a couple can protect up to 2412 million when both spouses have died.

For tax years prior to 2019 Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return. Arizona also allows exemptions for the following. If the taxpayer or spouse is legally blind andor born before January 2 1955 the following.

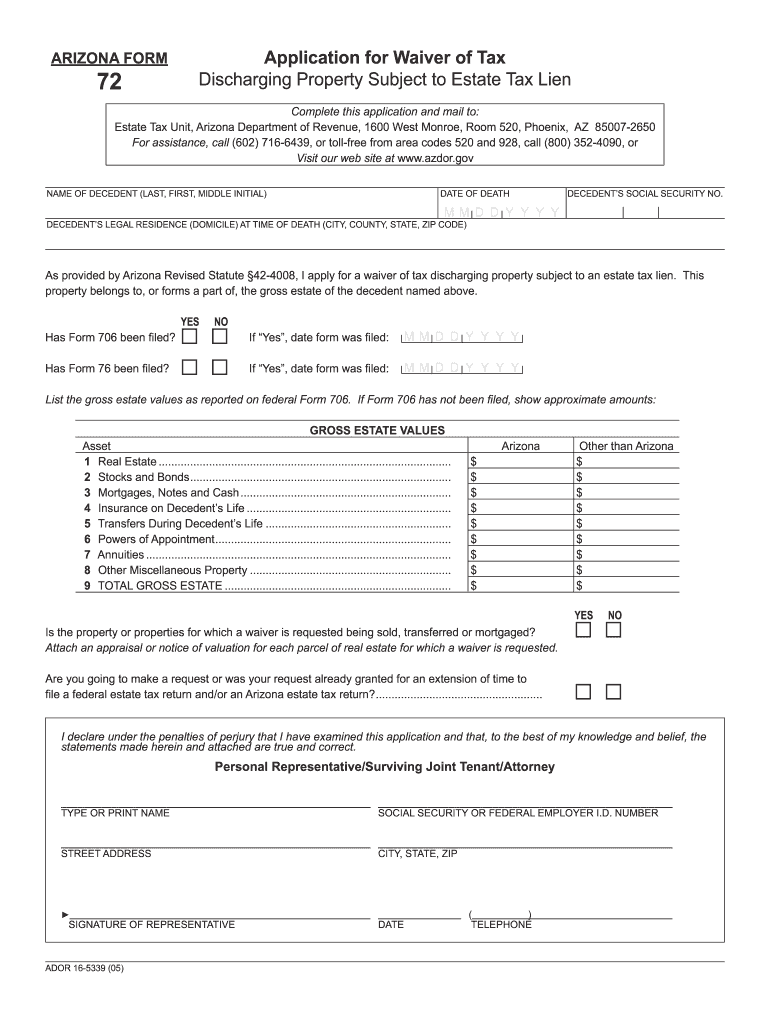

The federal inheritance tax exemption changes from time to time. For 2020 the standard deduction is 12400 for single filers and 24800 for married couples filing jointly. The purpose of the Certificate is to document and establish a basis for state and city tax deductions or exemptions.

The federal estate tax exemption is 1170 million for 2021 and increases to 1206 million for 2022. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. Tax Year 2019 Standard Deduction and Exemptions filed in 2020 Single - 12200.

The state sales tax of 56 does not apply to. Vermont does not permit portability of its estate tax exemption. The rate remains 40 percent.

Married Filing Separate - 12200. No estate tax or inheritance tax. 2300 x 259 60 2300 x 334 77 2300 x 417 96 2300 x 450 104 Other Exemption Qualifying Parent or Grandparent and the Other.

This means that on the federal level if your estate is valued at less than 11580000 when you die then your beneficiaries will not have to pay any federal tax on their inheritance. Even though there is no Arizona estate tax the federal estate tax may apply to your estate. The taxpayer or their spouse is blind.

The Internal Revenue Service announced today the official estate and gift tax limits for 2020. Arizona offers a standard and itemized deduction for taxpayers. TPT Exemption Certificate - General.

The estate and gift tax exemption is 1158 million per. Qualifying Widow er - 24400. We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Sales tax individual income tax corporate income tax and insurance premium tax. In FY 2020 these 4 taxes represented 946 of ongoing General Fund revenue. Tax is tied to federal state death tax credit.

The 2021 standard deduction is 12550 for single taxpayers or married filing separately. On June 18 2019 Vermont enacted H. Each marginal rate only applies to earnings within the applicable marginal tax bracket.

The exemption amount will rise to 51 million in 2020 71 million in 2021 91 million in 2022 and is scheduled to match the federal amount in 2023 Delaware. Starting with the 2019 tax year Arizona allows a dependent credit instead of the dependent exemption. Detailed Arizona state income tax rates and brackets are available on this page.

Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month period This is required only of individual estates that exceed a gross asset and prior taxable gift value of 1206 million 2412 for couples in 2022. The Arizona income tax has four tax brackets with a maximum marginal income tax of 450 as of 2022. Because Arizona conforms to the federal law there is.

The Arizona Department of Revenue is responsible. Head of Household - 18350. If your estate is valued above 1158 million youll only be taxed on the amount.

Arizona Department of Revenue tax credit. This amount is indexed and changes each year. The personal exemption is the subtraction from income for each person included on a tax return typically the members of a family.

The exemption is applied to the real estate first then to a mobile home or an automobile. It is to be filled out completely by the purchaser and furnished to the vendor at the time of the sale. For example the value of the other exemption amount at each tax rate is determined as follows.

The GST tax exemption amount which can be applied to generation-skipping transfers including those in trust during 2020 is 11580000 increased from 114 million in 2019. It was nearly doubled by Congress in 2017. Federal Estate Tax.

Is The Exemption For My House Only. What Are The Qualifications. It was repealed in 2017.

Worth 26 of the gross system cost through 2020. The annual exclusion for gifts made to noncitizen spouses in 2020 is 157000 increased from 155000 in 2019. The ballot measure would have exempted from personal property taxes the first 1 million of personal property used for agricultural trade or business purposes that is acquired in 2021 or.

541 which increased the Vermont estate tax exemption to 4250000 in 2020 and 5000000 in 2021 and thereafter. Personal Exemptions - ELIMINATED. Both Arizonas tax brackets and the associated tax rates were last changed two years prior to 2020 in 2018.

Tax rates - 259 334 471 450 No personal exemptions 1500 blind exemption 2300 exemption for medical dependent 2100 over 65 exemption Standard deductions 12200 18350 24400 plus 25 of charitable contributions that are not dedicated to credits. This tax is portable for married couples. 25100 for married couples.

The Arizona Business and Agriculture Personal Property Tax Exemption Amendment was not on the ballot in Arizona as a legislatively referred constitutional amendment on November 3 2020. Arizona has four marginal tax brackets ranging from 259 the lowest Arizona tax bracket to 45 the highest Arizona tax bracket. Total assessed valuation in Arizona must not exceed 27498 for the 2020 tax year.

What Are The Requirements For Property Tax Exemption In Arizona For Religious Organizations And Churches Provident Lawyers

Get And Sign Arizona Inheritance Tax Waiver Form

Arizona Estate Tax Inheritance Tax Guide For 2020

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax Planning In Arizona Gilbert Az Estate Planning Law Firm

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Estate Tax Planning In Arizona Inhertence Tax Plans Arizona Law Doctor

Arizona Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Arizona Estate Tax Everything You Need To Know Smartasset

Arizona Estate Planning Terms Definitions By My Az Lawyers

Recent Changes To Estate Tax Law What S New For 2019

New York S Death Tax The Case For Killing It Empire Center For Public Policy

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is The New Estate Tax Exemption For 2021 Phelps Laclair